Origin declaration of goods at customs

What are the risks in case of improper management?

In the international trade landscape, many companies focus on logistics, contract management, and import/export regulations. However, one of the most significant and often overlooked aspects is the origin of goods. Correctly identifying the origin of a product is not only a legal obligation but also a critical factor that can directly impact operational costs, compliance, and most importantly, a company's competitiveness. Incorrect identification of origin constitutes a violation of the Union Customs Code (Regulation (EU) No 952/2013) and subjects the company to administrative or criminal penalties under national law. The origin of goods is not limited to a geographical concept but involves the precise identification of where and how a product is manufactured or processed, following the rules set out in customs regulations. For companies operating internationally, properly managing this aspect can mean the difference between an efficient and profitable business operation and one subject to errors and penalties. This topic, often perceived as a technical detail, is in fact one of the fundamental pillars of customs and commercial compliance.

The hidden complexity of customs origin

The concept of customs origin of goods is intricate and multifaceted. International customs regulations primarily distinguish between two types of origin: non-preferential and preferential. While the former is determined by the country where the product was entirely manufactured or substantially transformed, the latter pertains to situations where the product's origin grants significant economic benefits in the form of duty exemptions or reductions, thanks to free trade agreements.

For many companies, the real challenge lies in determining which of these two categories applies to their products and, more importantly, how these distinctions can impact their commercial operations. In a globalized world, where supply chains involve multiple countries and a multitude of suppliers, it is easy to make identification errors. This can lead to costly consequences: from unpaid duties and delayed deliveries to legal penalties for regulatory violations, which can result in substantial fines and the seizure of goods. Financial penalties can vary based on the severity of the violation and can exceed 10% of the goods' value in cases of fraudulent or incorrect declarations.

The applicable regulations are governed by Articles 59 to 64 of the Union Customs Code (Regulation (EU) No 952/2013), Articles 31 to 70 of the Delegated Regulation (EU) No 2446/2015, and Articles 57 to 126 of the Implementing Regulation (EU) No 2447/2015. These rules regulate the application of preferential and non-preferential tariff measures (such as anti-dumping and countervailing duties), as well as impacting the protection of geographical indications, like "Made in Italy" and the Madrid Agreement.

Often, companies underestimate the importance of a correct origin declaration, believing it to be merely a bureaucratic formality. However, origin is a strategic aspect that can determine the success or failure of commercial operations, directly affecting costs and profitability. Making mistakes or ignoring the regulations on origin means exposing one's company to legal, economic, and reputational risks.

Penalties for incorrect or false declarations are severe. The importation or exportation of products with false or misleading origin indications, as provided for by Article 517 of the criminal code, can result in up to two years of imprisonment and a fine of up to €20,000. Furthermore, presenting products with false origin indications at customs or at retail sale carries economic and legal risks. While such violations can be rectified through the correction of the indications, they still expose companies to serious reputational and commercial consequences.

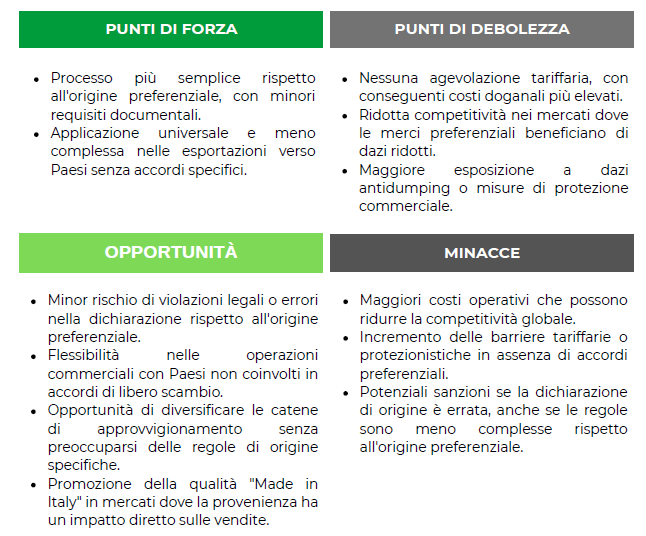

Non-preferential origin: understanding the implications

One critical scenario where the origin of goods plays a pivotal role is the importation of products from foreign markets. Many countries mandate that companies provide a non-preferential certificate of origin to ensure that goods comply with prevailing trade regulations. While this document does not confer tariff preferences, it is essential for monitoring the application of measures such as anti-dumping duties and import restrictions.

Consider a company exporting chemicals to a market with stringent anti-dumping regulations. If the certificate of origin is not generated correctly or if the origin is misstated, the company may be subject to substantial duties or, in severe cases, its goods could be detained at customs, resulting in catastrophic consequences for the business. Moreover, the risk of penalties for non-compliance with international trade regulations, such as those established by the World Trade Organization (WTO), could further jeopardize its reputation.

Preferential origin: a driver of competitiveness

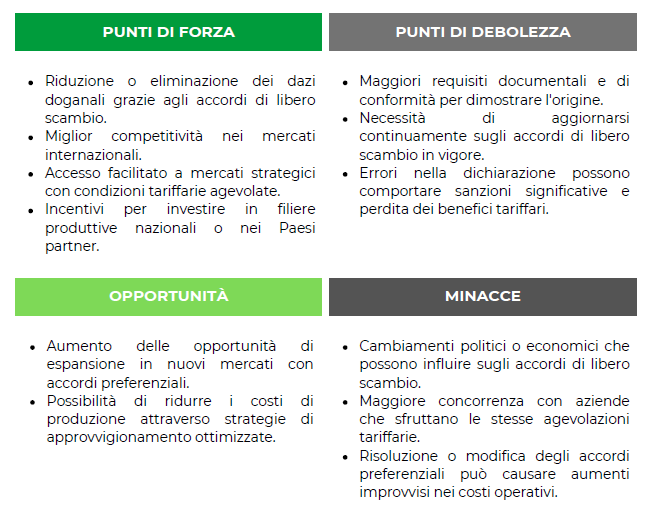

On the other hand, preferential origin represents a significant opportunity for companies seeking to enhance their competitiveness on international markets. Thanks to free trade agreements, goods that meet specific criteria can benefit from reduced or zero duties when exported to countries with which such agreements are in force.

The European Union, for example, has signed numerous preferential agreements with third countries, allowing goods produced in the EU to enter these markets under advantageous tariff conditions. However, to take advantage of these benefits, it is crucial for companies to correctly declare the preferential origin of their goods and demonstrate that they meet the requirements set out in European regulations. Failure to do so could result in companies having to pay standard duties, undermining their competitiveness.

A practical example would be a company that produces electronic components. If these components comply with the rules of preferential origin provided for in the free trade agreement between the EU and Japan, the company can export its products without its Japanese customer being forced to pay high customs duties. However, incorrect declaration of origin could result in significant financial penalties and the revocation of access to preferential markets.

The real cost of business negligence

The real issue, therefore, is not only the complexity of the origin of goods but also the fact that companies ignore and underestimate this topic. Many entrepreneurs still view customs compliance as a set of rules that must be followed to avoid fines, without considering that proper origin management can be transformed into a competitive advantage. Ignoring the correct application of origin regulations also means exposing oneself to reputational risks. In a world where transparency and sustainability are increasingly important for consumers, companies that do not comply with regulations can be perceived negatively, losing the trust of business partners and customers. Moreover, compliance with origin rules is essential to guarantee the ethics of trade and the protection of local markets from unfair practices.

How to tackle the problem?

To mitigate these risks, companies must adopt a proactive approach to managing the origin of goods. This involves not only a thorough understanding of applicable regulations but also the implementation of internal processes and tools to ensure that every stage of production and supply complies with the rules. Potential solutions:

.png)

A strategic asset for business success

The origin of goods is not merely a technical detail but a strategic element that can determine the success or failure of a commercial transaction. Companies that underestimate the importance of proper origin management expose themselves to economic, legal, and reputational risks. Conversely, those that adopt a conscious and proactive approach can achieve significant competitive advantages, reducing costs and accessing strategic markets under favorable conditions.